The FX market remains relatively slow (despite USDJPY), but we saw a push to the upside on the Dollar Index to a new high. However, resistance was found quickly. One reason for the higher US dollar yesterday was the higher US yields, while stocks remain trapped in slow consolidation. Hwoever, we may experience some volatility in the next 24 hours due to the end of the month, week, and quarter flows, as traders adjust their trading books.Additionally, the release of GDP, home sales, and core PCE index data from the US could impact the markets as well.

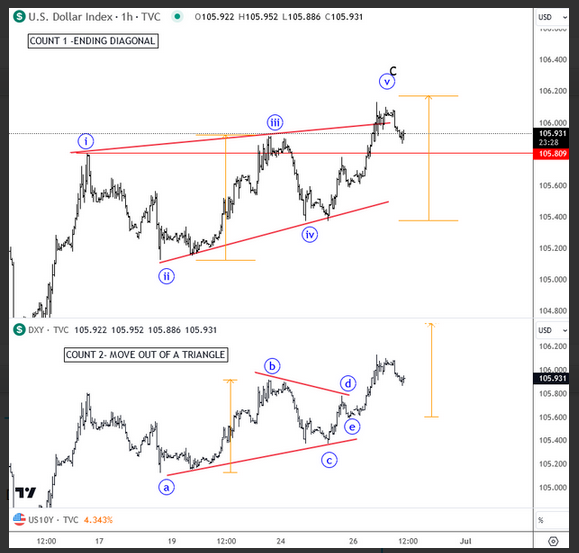

Looking at the Dollar Index hourly time frame, we see a potential ending diagonal, a reversal pattern. So far, there has been some reversal lower, but we need to see 105.60 broken to confirm the top. Alternatively, a triangle pattern is another valid scenario, with a limited upside but might extend above 106.20. In either case, we assume the dollar is trading near resistance.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.